ST. LOUIS – Missouri lawmakers and Gov. Mike Kehoe are exploring a plan to gradually phase out and ultimately eliminate the state’s annual income tax, a move one expert says would inadvertently hurt low-income residents.

Missouri’s current income tax includes taxpayer rates up to 4.7% depending on income levels. The tax generates billions of dollars annually that are used to fund state services, such as roads, education, social services and healthcare programs.

Sarah Narkiewicz, director of the Low Income Taxpayer Clinic at the Washington University School of Law in St. Louis, contends that eliminating the tax would disproportionately impact low-income residents.

The full article is available at ozarksfirst.com.

(Story by Joey Schneider, ozarksfirst.com)

Winter Storm Fern Arrives Tonight

Winter Storm Fern Arrives Tonight

Reeds Spring School District Announces Formation of an Alternative School

Reeds Spring School District Announces Formation of an Alternative School

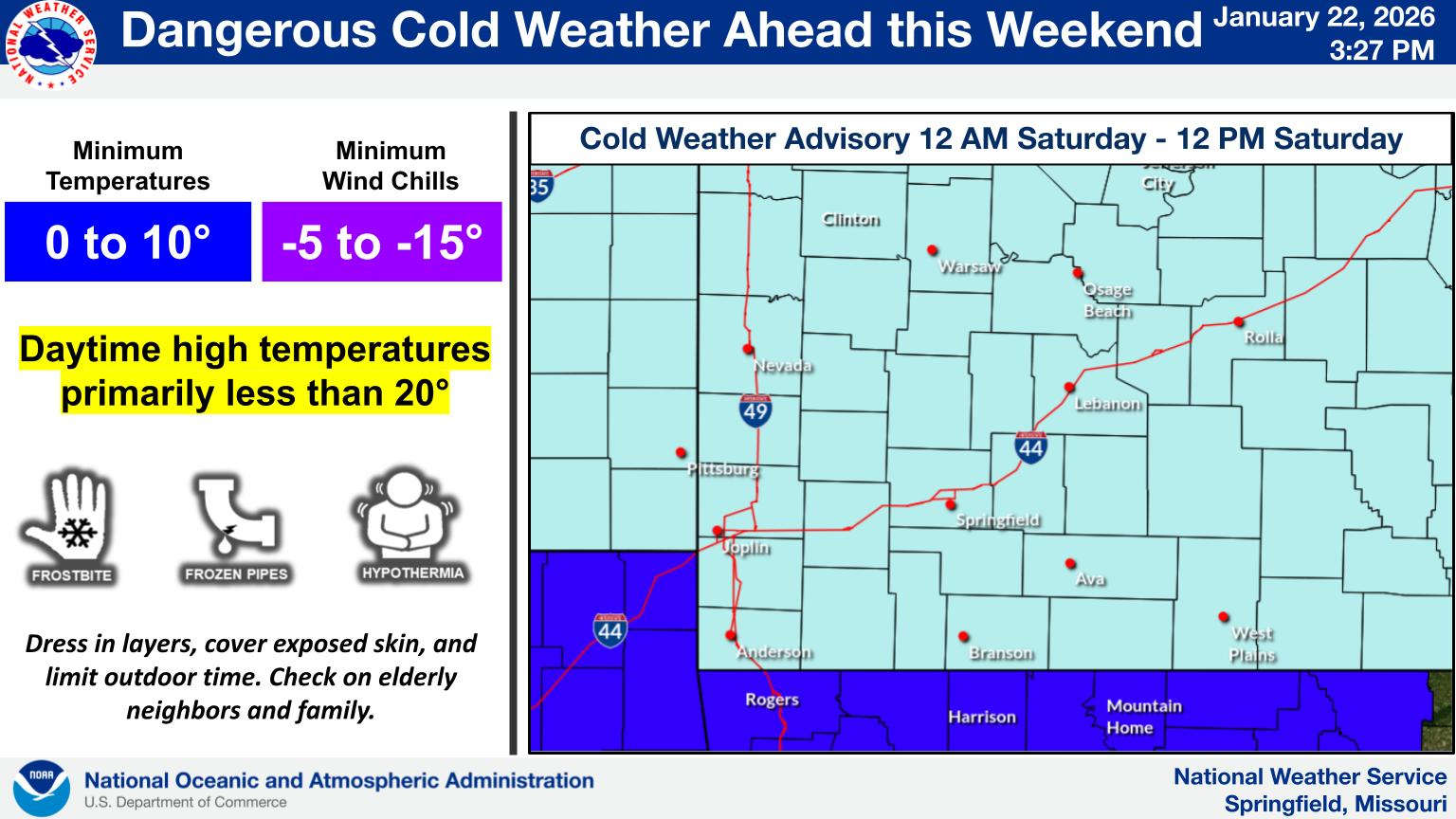

Weather Updates: Winter Storm, Extreme Cold Warnings Begin Friday

Weather Updates: Winter Storm, Extreme Cold Warnings Begin Friday